10 Ought To-Observe Techniques For Selecting The First Purchase House

Real estate arrives with a lot of positive aspects, and also potential pitfalls, particularly for starting up property investors. At REIstock, you should be sure that your 1st expense practical experience is really as positive and profitable as you can.

Let me suggest every thing you ought to know of before you purchase the first purchase house.

Just What The Industry experts Never Explain To You

You might already know that expense house supply you with once a month earnings and prolonged-time period understanding. You almost certainly also are aware that in case you use traditional leveraging, there is no need lots of money to invest in property.

On the other hand, in addition there are certain things to contemplate that agreement industry experts by no means explain to you:

- Stock markets plus the overall economy move through typical, foreseen down and up series. Being aware of this really helps to know how, when, and where to get home. - The more time you possess investment decision property, the greater rewarding it will usually be. Which is due to some extent to real-estate rounds, and in addition a result of the lengthy-expression aftereffect of house admiration. Real estate property will not be water. It can easily bring many weeks to trade to enable an income. - Purchasing investment real estate needs time. You must plan to looking into unique markets, and finding out how to use unique economical remedies to assist predict the actual possibility operation on the property.

Ideal In advance

Before You Decide To Make investments

Before you decide your initial expenditure real estate this is essential to prepare equally in financial terms and mentally. Whether you intend on being an active or passive housing buyer, a correct-and-flipper or perhaps a lengthy-yardage who owns complete rental property, you should definitely retain these essential things in your mind:

Possibilities Threats

Avoiding getting a dollars-losing residence, you should use the Roofstock Cloudhouse Car finance calculator to discover the rental probable associated with a individual-family home in the Oughout.Ersus. Simply enter the house address and obtain a total predict of possible come back.

When you buy a house at a individual owner or away from the The local mls, you run the risk of experiencing massive and dear fixes. The environment health and fitness or furnace may go out, or you might have a very important plumbing fix that may just be preset by way of a large-priced registered professional.

To prevent finding found unaware, create a money reserve be the reason for any crisis vehicle repairs, or get hold of a complete expense house that’s been thoroughly pre-checked and presently entertained by way of great occupant.

several. Vacancy amount beyond thought out:

Occasionally, as a result of area market place disorders, it will take over anticipated to locate a experienced actuel. While waiting, models like landscape designs, property taxations, plus the house loan still need to earn.

Once you build a pro forma financial plan on your own very first financial commitment real estate, try ‘stress testing’ it by refining diverse opening costs. Producing unique opening conditions provides you with a good suggestion of how much cash you’ll need to have in save in the event the house is placed bare in excess of anticipated.

Retirement Information

Some start property investors go “all in” if they invest in their very first expenditure home. They scrape together every single buck they've got, be lent from family and friends, although making practically nothing in hold to get a private emergency finance.

And some real estate trainers in the news could stimulate you to definitely function that, the issue is that ‘life happens’ then one might completely wrong whenever you smallest anticipate it, driving you to sell the initial rental at the worst possible time.

So, assume of ones own requires 1st a toronto injury lawyer 6-a year in financial savings, and triggering an IRA or 401(p). You'll also have the benefit of income tax-delayed savings, and also as extra benefit you can generate a self applied-directed Individual retirement account for paying for real estate, helping you to create a taxation-sheltered expense real estate stock portfolio.

Many lenders involve a how to wholesale houses for beginners fico score for at least 740 in an effort to give you the ideal charges and conditions for a mortgage using a domestic investment property. Substantial bank card account balances ought to be paid straight down, and ‘dings’ on your credit track record ought to be covered prior to applying for a lending product and earn a proposal over a accommodation.

In case you are money your purchase, some loan merchants may even require that you maintain 6-8 or more months of greenbacks in hold. Because of this, the financial institution appreciates you’ll be able to cash property finance loan if there is no local rental profits because of a higher than expected opening rate.

15 Measures for selecting A Investment Residence

Real-estate might be simply among the finest purchases you can make, furnished you go through correct actions:

#1: Determine that you truly desire to become property manager

Seeking to control a smart investment residence alone swallows a unexpected amount of time and your money. The most effective property investors employ a qualified property manager to oversee the everyday information on just about every home.

If as being a proprietor is not that for you, you can always purchase housing ultimately through a partnership, crowdfund, or maybe his comment is here a REIT.

#2: Eradicate large-attention personal debt

Credit cards, medical bills, and car loans can take a surprisingly huge chew from a private income. While many financial debt was not normally unnecessary, you do not want to be in times where you have to make a choice between paying the bank loan on the expenditure real estate or a bank card.

Number3: Conserve to your put in

Lenders commonly demand a bigger deposit for an purchase property or home. There are a handful of reasons to positioning extra money all the way down.

Initially, you'll also be handed a superior rate of interest and loans. Next, you will certainly have an overabundance of totally free cashflow due to a decrease payment. In most cases, using a traditional LTV relative amount (loan to value) of 75Per-cent by looking into making a 25Percentage put in provides plenty of money and cash pass to have a healthy and safe roi.

#4: Accumulate money reserves

Along with your pay in and shutting prices, you will also need to keep take advantage reserve for unexpected maintenance tasks or lowered local rental profits a result of elevated emptiness price.

You can increase your save account over time by adding to a restricted percentage of money move each and every month into a particular investment capital save account.

Number5: Think about very long-range real estate investing

The initial financial commitment home isn't going to ought to be while in the exact same location that you simply stay in. The fact is, there are several real estate investors who are living and operate in high-price promotes but invest extensive-distance.

The REIstock market place is a superb position to take into consideration individual-relatives and modest multifamily lease homes in eye-catching market segments across the country.

Number6: Review shelling out all money to funding

However the housing marketplace remains proceeding sturdy, there are plenty of very good purchase qualities out there cost under a Dollar100,000.

From time to time, it's important to move fast for the greatest discounts. Would like to spend in cash (or make an added-huge advance payment to speed increase loan consent) it is easy to refinancing at a later time in order to out several of your initial income.

For anyone who is money, you should get before-competent for a loan prior to an arrangement with an investment house. Things loan provider will look for incorporate:

- A fico score of at least 680 - Career history over the past 2 years and also income tax returns, and as much as 5yrs in case you are home-used - Cash on side with the downpayment - Detailed number of all liabilities and assets - Reduced credit card debt to income proportion (DTI) of 36Percent or less (while many lenders may possibly agree to a greater relative amount)

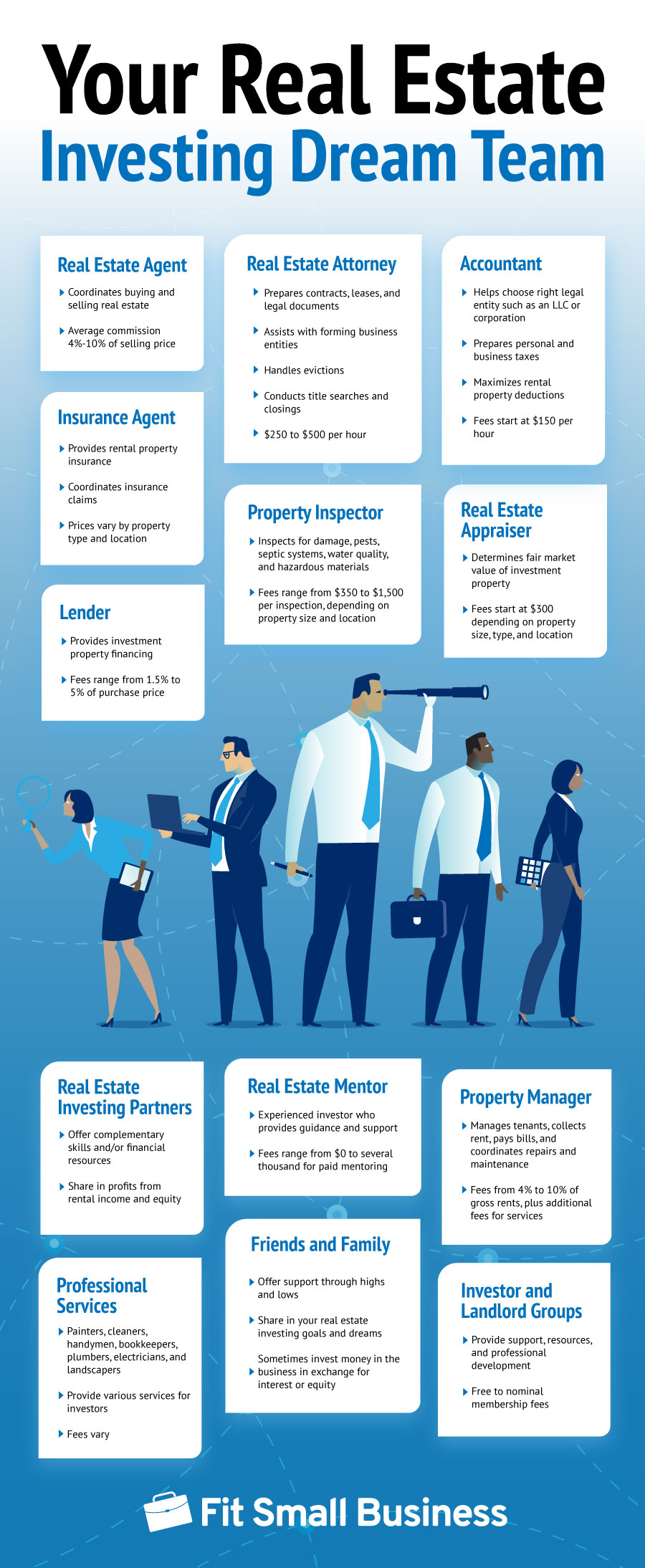

Number7: Build up your local property crew

Obtaining and buying your initial financial commitment property owner much different from shopping for the home. You will need to produce a real estate investment workforce composed of pros who recognize how cash flow property or home functions.

Key members of any nearby housing group may incorporate a broker who in concert with shareholders, a local loan company and attorney at law, in addition to a good home management company with an recognized community of price-helpful service pros.

Number8: Review each individual industry for a macro level

Some trading markets are superior to others for investment real estate. Elements that produce the place “good” rented real estate include:

- Human population advancement - Occupation progress and also a minimal redundancy charge - Average residence profits degrees - Number of tenant-occupied households escalating - Vacancy charges and median hire movements - Increase of property prices - Local community status - College rankings - Criminal offenses price

If you’re looking for a little bit more help on picking a marketplace, pay attention to this recent podcast episode where we will a serious plunge on this theme:

Number9: Grasp light beer financial evaluation

Soon after you have refined a place to get, the next step is to evaluate the opportunity financial operation of varied purchase selections. By looking at diverse houses to each other, you’ll get a superior feel for which property is the best for you.

Start off by setting up a proforma statement for each and every home. Start out with the house and property revenues, then deduct the opening and poor debts fees, regular functioning costs for example landscape designs and preservation, real estate administration service fees, as well as your house payment to find your online net income.

Other measurements you can use to investigate the opportunity personal functionality of each rental property consist of:

Hat minute rates are a percentage that blogs about the home net gain (excluding the payment) for the cost: Cover amount Equates to NOI Versus Monatary amount Hard cash-on-cashback is a ratio that compares the money obtained for the income expended: Cash-on-funds Is equal to Cashback And Cash devoted 1Pct guideline blogs about the disgusting regular monthly rent payments to the overall cost of your house, where by the larger the ratio is over 1Pct the greater: Hire ration Equates to Regular monthly hire And Real estate price tag

Number10: Go ahead and take jump!

Search for guides and listen to podcasts until you could be blue in the face, but eventually, you are going to have to take the jump and then make that primary provide.

Quite a few initial-time traders tend to get a entire home, which means the exact property have been a short while ago rehabbed and it is rent-geared up. In truth, many of the properties (just like the kinds for auction on Roofstock) already have the renter available so you will have net income on first day.

You may also often prefer to enjoy for a rehab if you believe cozy dealing with an undertaking.

Very last Pimple free Buy Your Initial Purchase Real estate

You can find a numerous benefits to having investment property. Occupant housing costs cover your doing work bills and house loan, with any leftover earnings excess as income. Property or home downgrading will then be utilized to decrease your number of after tax net profit, sometimes to absolutely nothing (even when you basically make a cash benefit).

Investment real estate property is additionally a powerful way to branch out your investing, preserve for old age with a self applied-focused Individual retirement account legitimate home, and prepare your wealth over the long term. Of course, every benefit is sold with likely drawbacks in addition.